News Article

QIMA 2023 Q2 Barometer

Global Buyers Eye China’s Tentative Comeback, While Need for Supply Chain Digitization Grows

With China back in the fray, 2023 promises stronger competition among Asia’s manufacturing powerhouses in the ongoing redistribution of trade flows. Meanwhile, as new supply chain challenges arise from greater sourcing diversification and the increased impact of ESG regulations, more businesses are turning to digital solutions to improve supply chain visibility, take control of product quality and manage supplier compliance. This barometer report is informed by QIMA’s data on inspections and audits, as well as the insights from our latest survey of over 250 consumer goods businesses with international supply chains.

After a tough 2022, is China ready to come back swinging?

After hitting new lows of buyer confidence last year, China sourcing appears primed for a promising comeback in 2023. Official statistics show that in the wake of lifting “zero COVID” restrictions, China’s factory activity in Q1 followed a recovery trend; QIMA data for the same period shows +3% YoY expansion in demand for China inspections and audits globally, marking a first quarter of positive growth since early 2022.

Notably, QIMA figures suggest that China’s growth in Q1 was driven by emerging regions more than Western buyers: demand for China inspections and audits from businesses based in Asia and Latin America was up +37% YoY and +20% YoY respectively, compared to a paltry +2% YoY from buyers based in the US and the EU.

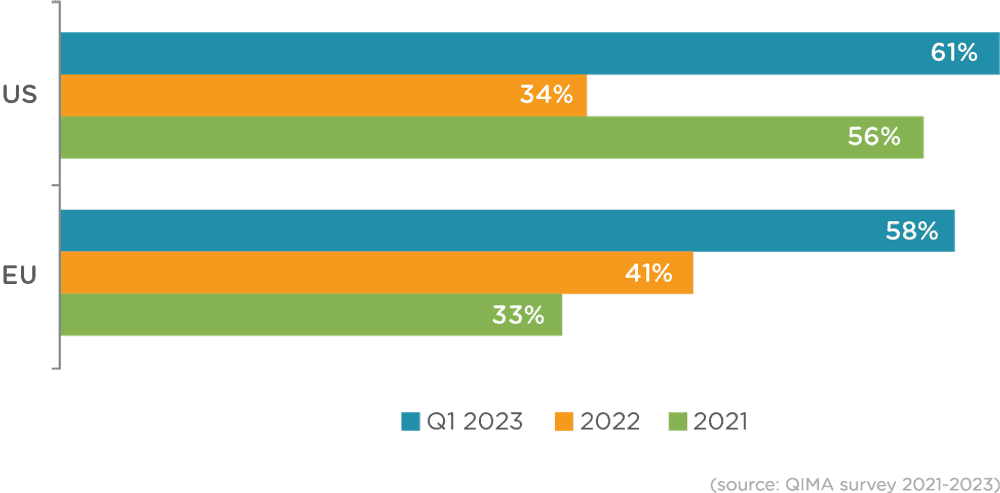

The findings of QIMA’s Q1 2023 survey of brands with international supply chains further confirm that Western brands are still following the long-term trend of diversifying away from China: even as the “world’s factory” still dominates their list of TOP3 sourcing partners, 61% and 58% of US- and EU- based respondents, respectively, reported that their China buying volumes in Q1 2023 were lower than a year ago.

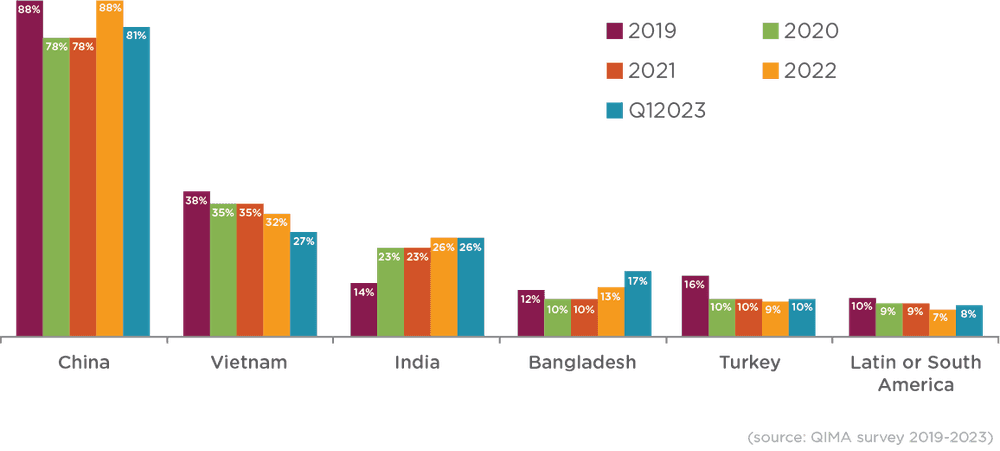

Figure C1: Sourcing regions named among TOP3 by US- and EU-based businesses (excluding home region)

Figure C2: Western buyers reporting decreased China buying volumes over the past 12 months

Competition across Asia’s supplier markets poised to intensify in 2023

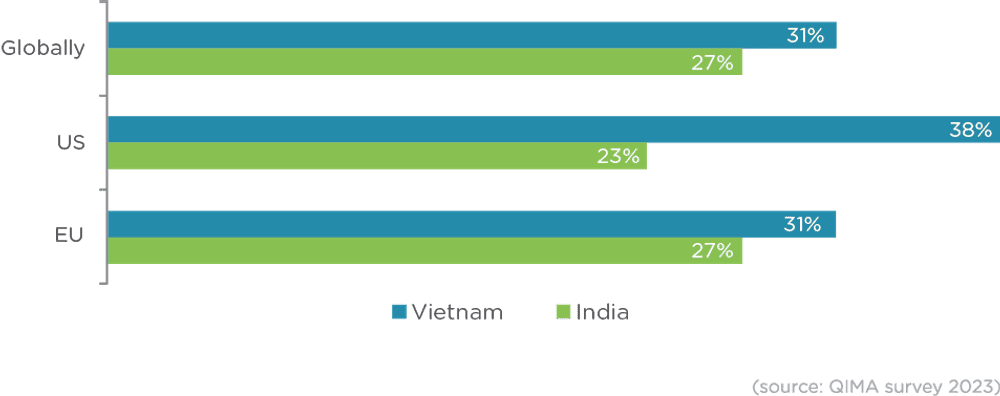

Frequently seen as the biggest winner of the recent years’ sourcing shifts, Vietnam saw strong competition from its neighbors in the region in Q1. While almost one-third of QIMA survey respondents chose Vietnam when diversifying their buying geography, QIMA data on inspection and audit demand from Western buyers shows that Vietnam’s expansion pace (+5.5% YoY) was behind other popular supplier hubs in Southeast Asia, such as the Philippines (+26% YoY), Cambodia (+25% YoY), Thailand (+21% YoY) and Indonesia (+20%).

That said, all of Southeast Asia’s supplier markets will have to work hard to retain their attractiveness throughout 2023. Because the regional “China alternatives” lack the original’s mature manufacturing infrastructure, they often struggle to provide adequate production capacity and skilled labor. With China back in the game, some buyers may shift their orders back; others will cast their nets further afield – more often than not, towards India and Bangladesh.

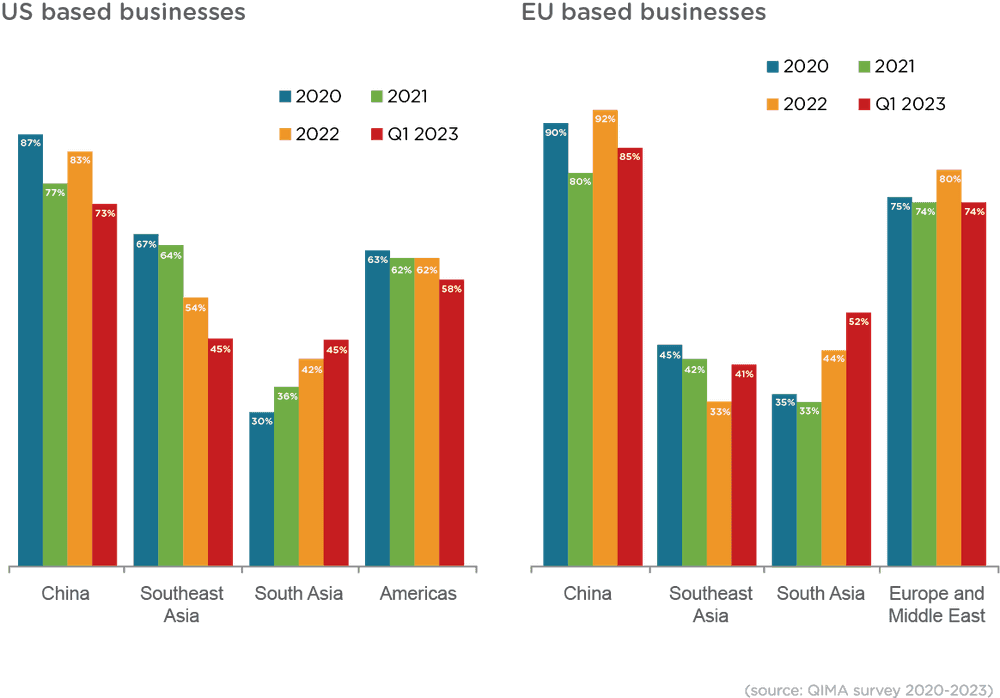

Indeed, data from QIMA’s global sourcing survey shows that South and Southeast Asia have become equally important as supplier regions for US-based buyers, while among EU-based businesses, South Asia has overtaken Southeast Asia in popularity starting from 2022.

Fig. A1: Respondents reporting increased sourcing from Vietnam and India in the past 12 months (% of those that made significant changes to their supplier geography in the same period)

Fig. A2: TOP3 aggregated sourcing regions of US- and EU-based businesses

Over half of businesses aim to incorporate nearshoring as part of their sourcing strategy in 2023

The findings of the QIMA survey combined with QIMA’s data on inspection and audit volumes indicate that near-shoring remains an important element of global sourcing. 57% of businesses globally reported plans to increase buying from their home and/or neighboring regions in 2023.

US-based brands, eager to lessen their dependence on sea freight, have been stepping up their sourcing presence in Latin and South America, with Q1 demand for US inspections and audits expanding +11% YoY in Mexico, and +32% YoY in Guatemala.

Meanwhile, European buyers continued growing their procurement footprint in the Mediterranean, resulting in double-digit growth for inspections and audits in the region (+29% YoY in Q1). This included a swell of new orders from Turkey, as part of EU brands’ collective promise to support the country’s textile and apparel industry in the wake of the devastating February earthquake.

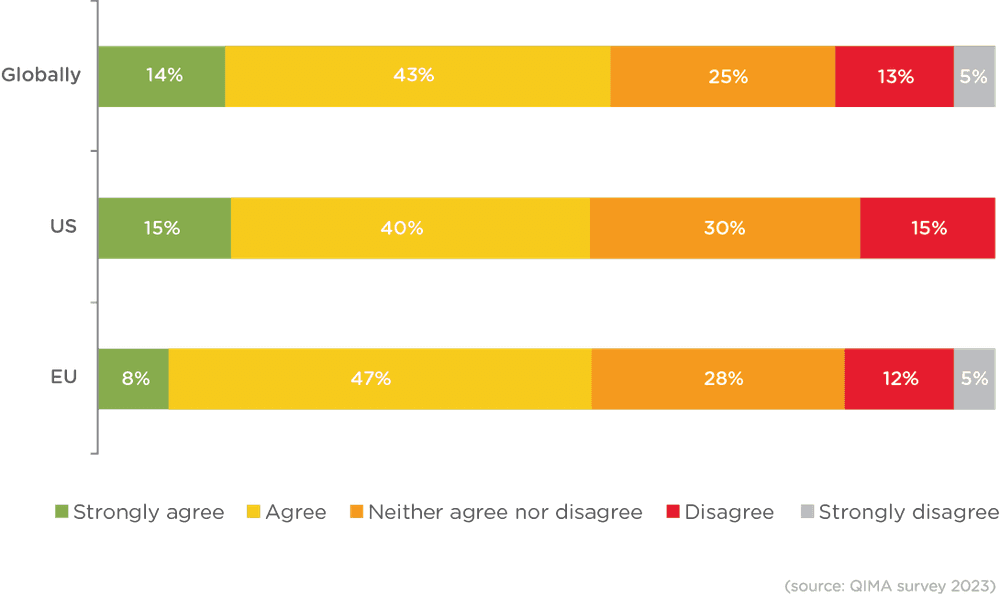

Fig. N1: How buyers feel about nearshoring as a part of their supply chain strategy over the next 12 months

Brands see digital transformation as a key tool for better visibility, compliance and quality management

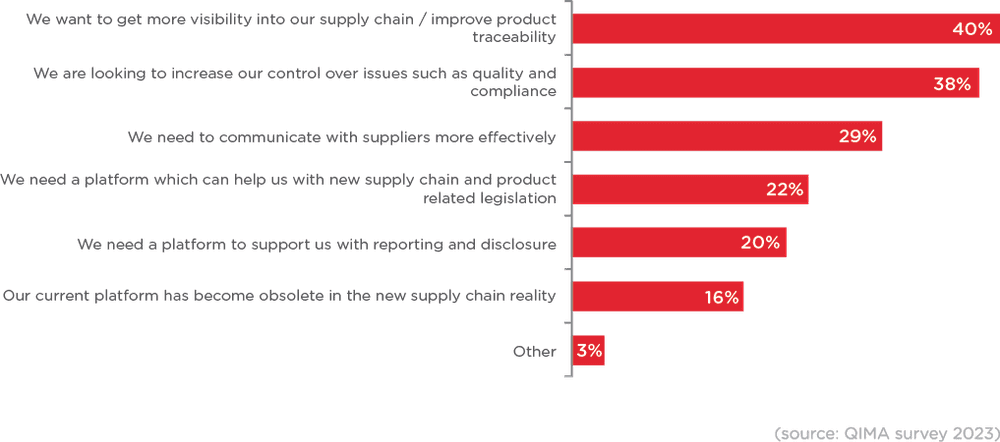

Businesses worldwide increasingly look to supply chain digitization as a solution for new sourcing challenges arising from increased supplier diversification and tightening ESG regulations.

The prime factor driving supply chain digitization in 2023 is the need for greater supply chain visibility and product traceability, named by 40% of respondents of the QIMA survey as their chief impetus for investing in supply chain tech – a clear reflection of the increasing impact of ESG reporting regulations and the growing weight of supplier compliance in sourcing decisions.

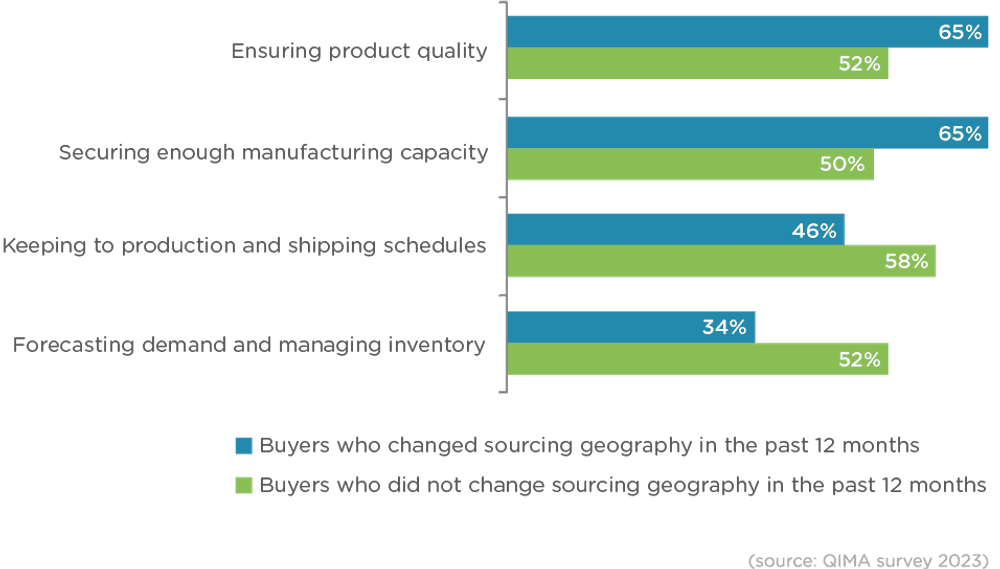

Meanwhile, QIMA survey respondents’ second biggest reason to invest in supply chain technology was to better manage product quality and supplier compliance – the traditional pain points of international supply chains recently made more acute by increased diversification. Indeed, businesses with recently-diversified supply chains consistently reported greater struggles with product quality compared to those that have not changed their supplier geography in the past 12 months.

Fig. D1: Top reasons to invest in new or increased supply chain technology and digitization over the next 12 months

Fig. D2. Top sourcing challenges named by respondents globally

Press Contact

Email: press@qima.com