News Article

QIMA 2024 Q1 Barometer

Q1 2024 BAROMETER: 2023 in Review: Is Nearshoring Becoming China’s Plus One?

Between global economic downturn and geopolitical tensions, 2023 placed significant pressure on brands and retailers to optimize their costs and secure their supply chains. For many, this meant refocusing their attention on China, increasing nearshoring efforts, or pursuing both strategies simultaneously. Meanwhile, ongoing challenges with supply chain visibility indicate that businesses are far from prepared for the impending wave of ESG legislation set to take effect in the coming months. This barometer report, informed by QIMA’s internal data and the findings of our survey of 800+ businesses with international supply chains, offers a retrospective of 2023 in sourcing and expectations for the coming year.

2023 Sees China Sourcing Back in the Game

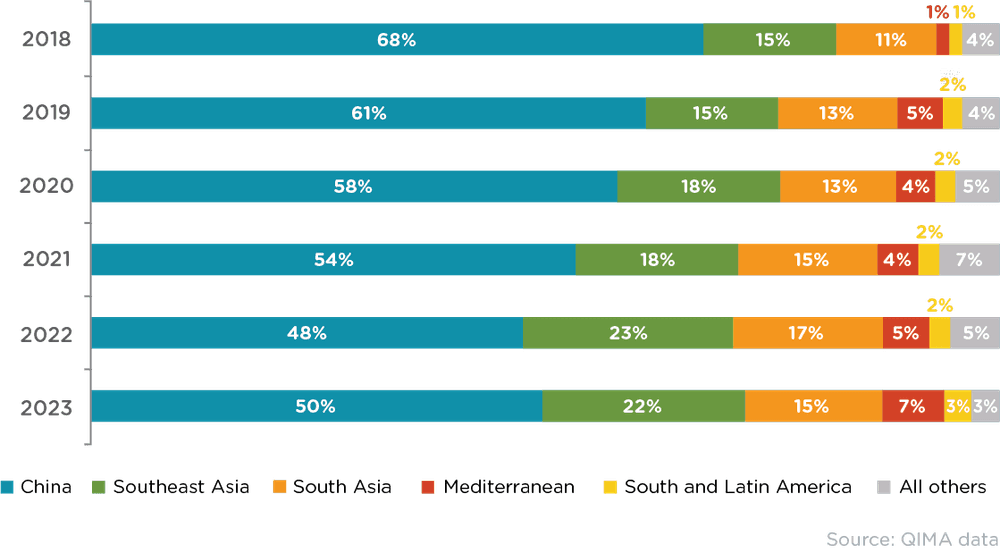

After several tumultuous years of pandemic-related disruptions and logistical challenges, China sourcing appears to have solidified its recovery in 2023. QIMA data shows that demand for China inspections and audits among US-and EU-based buyers has increased +5.4% YoY in 2023; while China’s relative share in these buyers’ supplier portfolios has ticked up for the first time since 2018 – a trend highlighted in our Q4 ’23 barometer, which has further strengthened since then.

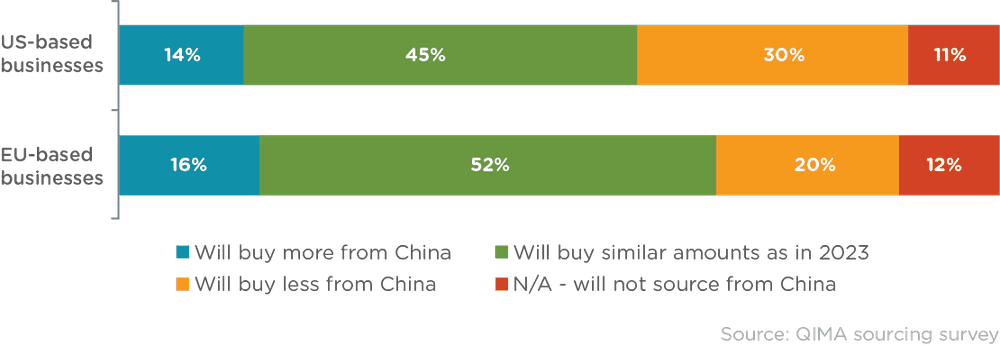

As we enter 2024, there is room for optimism for China sourcing, both on a global scale and in the West. In QIMA’s survey, 59% of US-based respondents and 68% of those headquartered in the EU reported plans to maintain or increase business volumes with Chinese suppliers. Additionally, emerging markets are expected to continue playing a significant role for China: for instance, QIMA’s data shows that inspection and audit demand from businesses based in Latin and South America was up +17% YoY in 2023. While domestic markets contribute to this growth, a substantial portion of it can be linked to the rising volumes of nearshoring by US brands, which drives demand for Chinese raw materials and components among local businesses.

However, it is important to remember that during the past five years, the global supply chain landscape has become increasingly volatile, and the impact of geopolitics on trade is greater than ever. Bearing this in mind, any predictions for China sourcing in 2024 must consider that the US presidential election has the potential to further reshape the US-China trade relationship.

Fig. C1: Top supplier markets of US- and EU-based buyers (relative share in sourcing volumes)

Fig. C2: “How much business do you plan to do with Chinese suppliers in 2024, compared to 2023?”

Nearshoring Picks Up Steam, Diverting Larger Buying Volumes from Overseas Markets

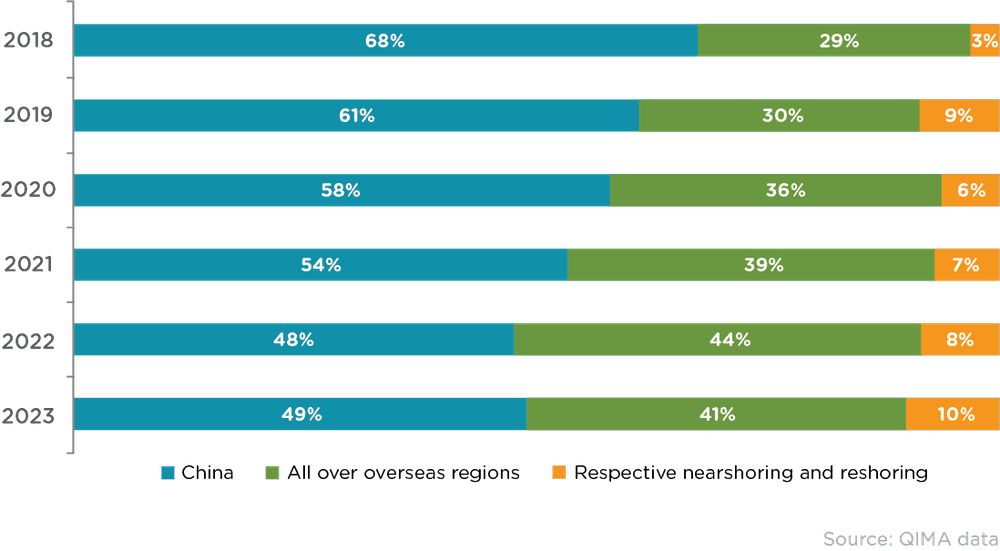

The popularity of nearshoring and reshoring has continued to grow throughout 2023, to the extent that volumes sourced from home and nearby regions are increasing at the expense of the overseas supplier markets (except China). QIMA’s data on inspection and audit demand for 2023 shows an uptick in the relative share of respective nearshoring and reshoring regions among US- and EU-based buyers, now accounting for a total of 10% of their procurement.

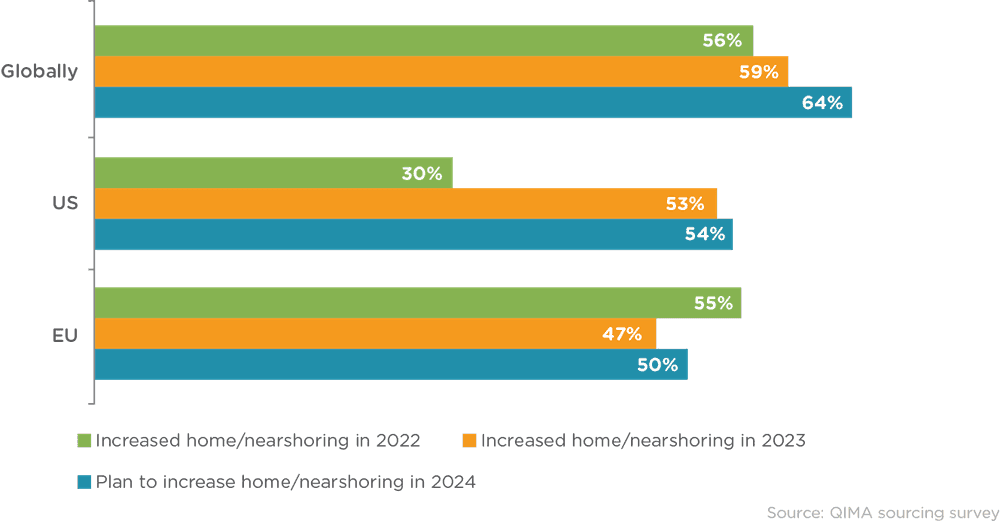

Furthermore, while in the past, European businesses have been more inclined to purchase from suppliers closer to home, findings of the QIMA sourcing survey indicate that US-based buyers are now equally interested in near-and reshoring. QIMA’s data on inspection and audit demand backs this up: Mexico, which overtook China as the US’s #1 trade partner this year, saw demand for inspections and audits expand by +16% YoY in 2023.

Thus far, the trend towards increased nearshoring and reshoring shows no signs of slowing down. Looking ahead, 54% of US-based and 50% of EU-based respondents reported plans to source more from suppliers in their home and nearby regions in 2024.

Fig. N1: Relative share of overseas and home regions in procurement for US- and EU-based buyers

Fig. N2: Evolution of buyer interest in nearshoring and reshoring, 2022-2024 (by respondent HQ location)

Asia’s Supplier Markets Struggle in the Context of Weaker Global Demand

Following a period of explosive expansion in 2022, South Asia sourcing experienced a slower year in 2023. Bangladesh, in particular, faced challenges with wage disputes and the ongoing political crisis that brought large swaths of manufacturing to a standstill in the fourth quarter. Meanwhile, India, although still a top choice for overseas sourcing among the QIMA survey respondents, saw the pace of new business expansion slow down. Among the factors behind the lull are the country’s protectionist policies, which have reportedly impacted recent supply chain decisions made by majorWestern companies. With South Asia’s two flagship supplier markets on the back foot in 2023, QIMA data shows demand for inspections and audits in the region sliding back to around 2021 levels.

In comparison, Southeast Asia fared better, but the growth pace was dampened by weakening global demand. Cambodia was ahead of the pack, according to QIMA data, with inspection and audit demand +11% YoY in 2023 marking a third consecutive year of double-digit expansion; while Vietnam, Indonesia and the Philippines all saw year-on-year growth hover around the +5% mark.

Ethical Compliance Correlates to Maturity of Sourcing Region, as Shown By Audit Data

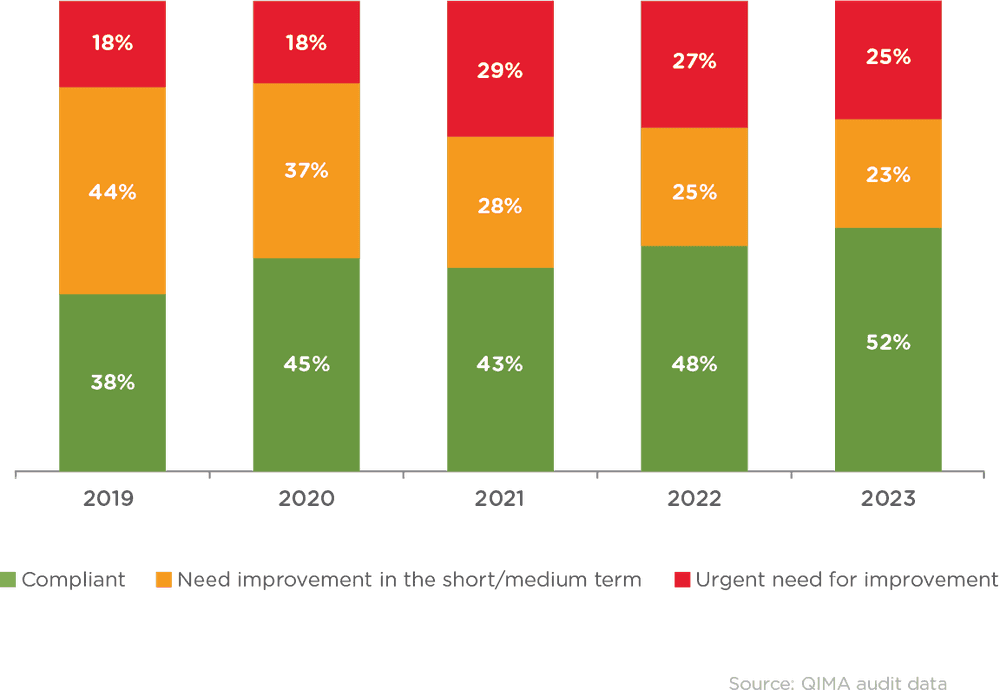

When polled by QIMA, nearly two-thirds of survey respondents said that supplier compliance had become more important to them compared to a year ago, with 70% reported taking at least one ESG factor into consideration in their sourcing decisions. However, data from field audits revealed that progress on ethical compliance was slow in 2023. One-quarter of inspected factories were assigned a “Red” ranking that indicated a need for urgent remediation (vs. 27% in 2022). The most pressing issues were health and safety and Working Hours and Wages, which accounted for 31% and 36% of all critical non-compliances found by QIMA auditors in 2023, respectively.

Low supply chain visibility may be at the root of the gap between ESG strategies and actual implementation: only 16% of the QIMA survey respondents reported knowing all of their suppliers (across all tiers), and almost a third of businesses knew less than 50% of their supply chain.

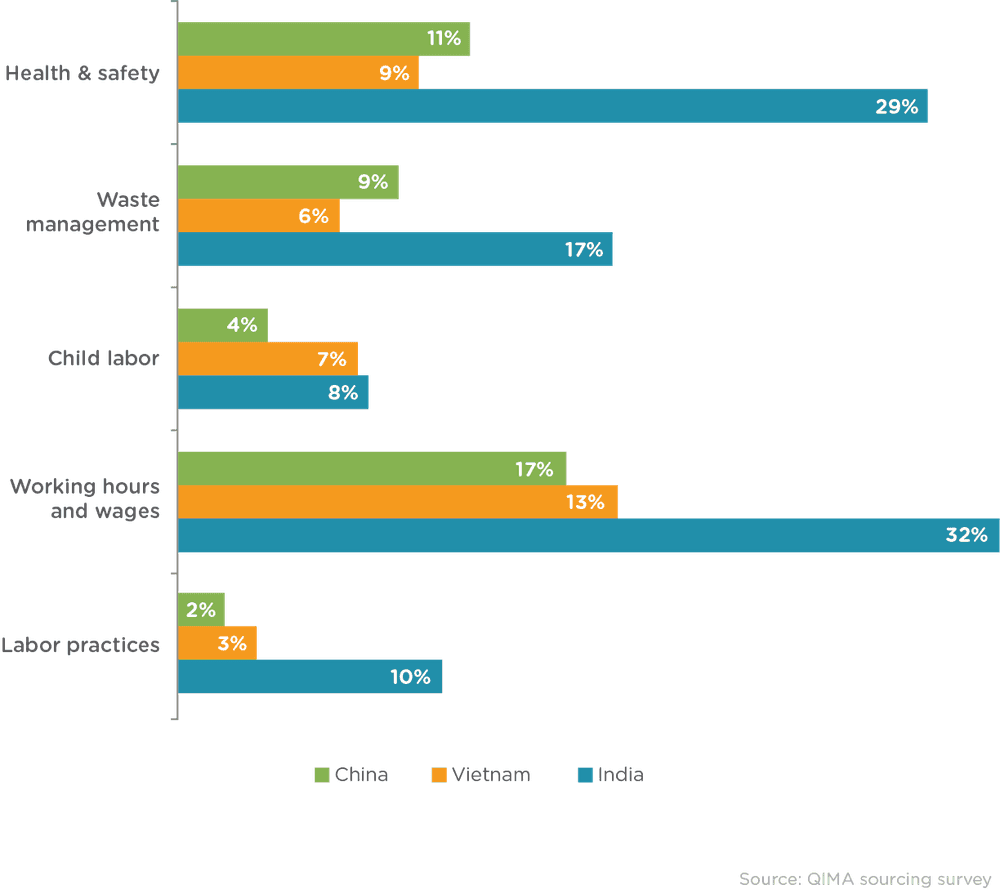

Audit data by country also suggests a positive correlation between ethical compliance and the maturity of the sourcing region. For instance, in China, QIMA auditors recorded critical Health & Safety violations in 11% of audited factories – while in India, that figure was 29%. This pattern was observed across all aspects of ethical compliance covered by QIMA audits, including child labor, which was twice as likely to be found in Vietnam’s and India’s factories than in China.

Fig. E1: Evolution of factory rankings assigned by ethical audits, 2019-2023 (global averages)

Fig. E2: Percentage of audits where critical violations in stated categories were discovered in 2023 (comparison by country)

2023’s Top Supply Challenges Extend into 2024: Brands Bracing for a Tough Year

The list of supply chain challenges of 2023, as ranked by respondents of the QIMA survey, was dominated by rising costs, demand fluctuations and geopolitical tensions – all of which are expected to persist in 2024. As the availability of working capital decreases and inflation affects consumer spending, brands and retailers will face increased pressure to optimize costs and mitigate risks, with nearshoring likely being one of the strategies employed. The ongoing rollout of ESG regulations presents an additional challenge, emphasizing the need for greater supply chain visibility.

Press Contact

Email: press@qima.com